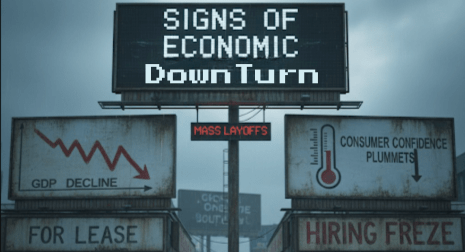

Signs of Economic Downturn

Fast food chains are shuttering. Luxury hotels are evicting guests. Credit scores are falling for the first time in a decade. This isn’t just a downturn. It’s a wake-up call. These are Signs of Economic Downturn.

The headlines may say “resilient,” but a deep dive into the data reveals a “full-body economic ache.” This isn’t just inflation; it’s a systemic tightening felt from Main Street to Wall Street. As finance majors with a strong grasp of economic dynamics, we look beyond surface-level job reports. Our attention centers on the deeper financial stress affecting households and businesses. This perspective reflects a commitment to understanding the real economy—not just the headlines.

This is an update on the 15 signs from my previous blog. It includes a critical bonus sign on fiscal health. These signs indicate that the U.S. economy is facing a reckoning not seen since 2008.

The Full-Body Ache: 15 Signs America’s Economy Is In Its Worst Shape Since the Great Recession

II. Section 1: The Consumer Solvency Crisis (Signs 1-3, 12, 13)

Focus on debt, credit, and confidence, using the strongest data points.

- 1. Credit Card Debt Hits Record Highs & High APRs: U.S. balances are now over $1.23 trillion (Q3 2025), carrying an average APR of nearly 23%. This debt isn’t for luxury; it’s for survival.

- 2. Auto Loan Delinquencies Surging: The 60+ day delinquency rate has reportedly exceeded the 2009 Great Recession peak. This has occurred in some categories. This signals widespread distress among core borrowers.

- 3. Credit Scores Are Dropping: The average FICO score has begun falling for the first time in over a decade. This decline is driven by rising utilization. Another factor is student loan payments resuming (Sign #12).

- 4. Consumer Confidence Hits Near-Historic Lows (Sign #13): The University of Michigan’s sentiment index is hovering near all-time lows. It is lower than the 2008 recession. This confirms that Americans feel a deep pessimism about their financial future.

III. Section 2: Real-Economy Collapse and Affordability (Signs 4-10, 14, 15)

Focus on housing, wages, retail closures, and social indicators.

- 5. Retail Apocalypse 2.0 & Small Business Closures (Signs 4 & 9): Major brands like Wendy’s are closing hundreds of locations. This is due to slumping low-income sales. Big Box chains like Macy’s (closing 150 stores) and Walgreens (closing 500 stores) are downsizing massively.

- 6. Real Wages Falling Behind Inflation (Sign #8): Despite recent nominal gains, real average hourly earnings are cumulatively down due to the high inflation. This inflation has eroded purchasing power over the last few years.

- 7. Renters on the Brink & Homelessness Rising (Signs 6 & 10): The national homelessness count has surged by 18%. Family homelessness is rising even faster. This is an indisputable reflection of the housing affordability crisis.

- 8. Mass Layoffs & The White-Collar Reckoning (Sign #7): Job cuts are impacting sectors like tech, retail, and manufacturing. These cuts lead to some of the highest layoff totals seen since 2003. This isn’t just blue-collar labor; white-collar job cuts are signaling a corporate pullback in anticipation of a wider slowdown.

- 9. Healthcare Costs Skyrocketing (Sign #14): With national health expenditures projected to climb toward 20% of GDP, essential care acts as a non-discretionary, crippling inflation point for families.

- 10. Luxury Spending Shrinks (Sign #15): The contraction in spending is moving up the income ladder. The overall luxury market is facing its first major contraction since 2009 (excluding COVID). Affluent consumers are prioritizing experiences such as travel and services. They prefer these over tangible goods like handbags and jewelry. This suggests that even the wealthy are shedding depreciating assets and preparing for volatility.

IV. Section 3: The Systemic Risks (Signs 11 & Bonus)

Address the financial system and macro-level instability.

- 11. Bank Failures & CRE Exposure (Sign #11): The failure of Silicon Valley Bank (SVB) exposed banks’ vulnerability to interest rate risk. Today, the focus is on regional banks. Commercial Real Estate (CRE) debt makes up an elevated 44% of their total loan portfolio. This presents a major credit risk. Nearly $1 trillion in CRE loans are set to mature by the end of 2026.

- BONUS SIGN: The Unsustainable Federal Debt: The U.S. national debt is roughly $35 trillion, with the debt-to-GDP ratio nearing 100%. The cost of servicing this debt is now one of the fastest-growing federal expenditures. It threatens the nation’s ability to fund future programs. It also hampers its capacity to respond to the next crisis.

V. Signs of Economic Downturn Conclusion & Call to Action

Final Takeaway:

This isn’t just a recession—it’s a reckoning. We must reframe luxury as resilience. Financial literacy isn’t optional; it’s survival. And understanding these 15 signs is the first step toward protecting your own wealth.

Ready to shift your thinking from panic to preparation? To truly prepare for volatility, you need the right mental framework. Learn the secrets of financial resilience and adopt the winning mindset with my book: Money Mindset: The Millionaire Mindset.

Call to Action:

- Comment: Which of these signs have you felt personally?

- Share: Send this post to someone who still thinks “the economy is fine.”

- For more free guides, tools, and resources: Shop my blog store

🔥 Subscribe to the blog for more Wanderlust & Wealth Wisdom gems!

Leave a Reply